Energy Industry Summary – Week of December 20th, 2021

Commodity Fundamentals

• NG ’21 prompt-month opened at $3.84/MMBtu on Tuesday, December 21th, up slightly from yesterday’s settlement.

• WTI ’21 prompt-month futures opened at $69.21/bbl on Tuesday, December 21th, up from yesterday’s settlement of $68.61/bbl.

• Coal spot contracts (Central Appalachia) are trading at $92.50/ton, unchanged from the previous week EIA reported on December 17th.

Natural Gas Fundamentals – Neutral

• Prompt-month NYMEX natural gas opened trading on Tuesday, December 21th at $3.84/MMBtu, up slightly from the previous settlement.

• Prompt-month NYMEX natural gas traded up modestly in early morning trading at $3.87/MMBtu.

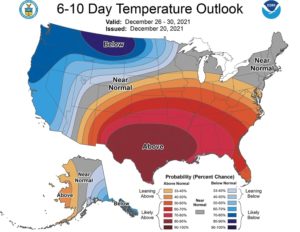

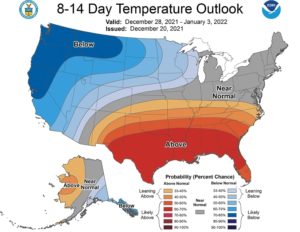

• Temperatures may be shifting colder by the end of the month.

Crude Oil – Neutral

• Prompt-month crude oil prices opened on Tuesday, December 21th at $69.21/bbl, up slightly from yesterday’s settle.

• Prompt-month crude traded up $1.70/bbl in early morning trading.

• COVID-variant concerns continue to influence the crude oil market.

Economy – Bullish/Neutral

• Senator Manchin (D-WVA) said that he would not support the Biden Administration’s Build-Back-Better legislation, forcing Democrat lawmakers to regroup and attempt an alternate bill.

• Major U.S. stock indexes have been trading down in response to concern over Omicron, Fed Policy, and what appears to be a serious road block in the Biden Administration’s signature legislation.

• The worlds richest man, Elon Musk, said that he will pay $11 billion in income taxes in 2021, The Wall Street Journal reported.

Weather – Neutral

• Cold Canadian air will slowly move into the Upper Midwest in the 8-14 day outlook.

• This cold air will also bring winter to the Northeast and much of the Mid-Atlantic U.S. in early January.

• The cold air is in place, but the key to unlocking it (aka “blocking”) is still not sufficiently in place to drive the cold into parts of the South and Southeast.

|

|

Weekly Natural Gas Report:

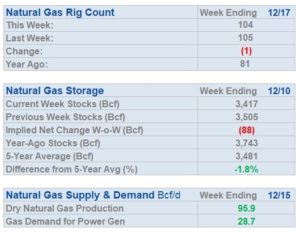

• The Energy Information Administration (EIA) reported a withdrawal of 88 Bcf from underground storage for the week ending December 10th, 2021. Inventories are 3,417 Bcf, which is -9% less than the same period last year and -2% less than the 5-year average. For the week ending December 10th, Baker Hughes reported 105 gas-directed rigs, up +3 from the prior week. Oil-directed rigs were at 471 for the same period, up +4 from the previous week.

|

|

Weekly Power Report:

Power – Volatility Easing

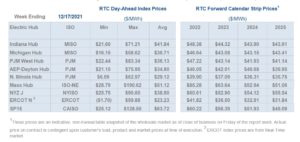

• Power prices in the mid Atlantic and the Great Lakes Region were up one to three percent from the prior week. Real-Time prices in ERCOT averaged $23.23 per Mwh.

|

|

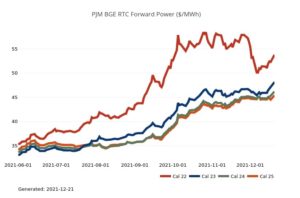

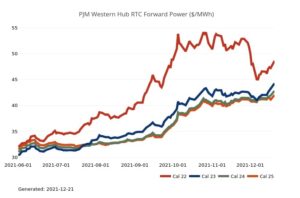

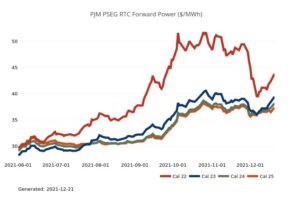

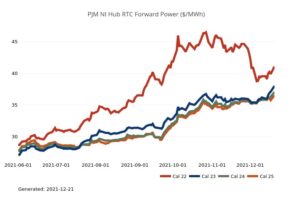

Mid-Atlantic Electric Summary

• The Mid-Atlantic Region’s forward power prices moved up last week, mostly on the front part of the pricing curve (2022/23) despite natural gas prices that trended slightly downward during that time. Those power prices could see some more price support heading into the holiday weekend as U.S. natural gas futures rose, Monday, on forecasts for colder weather and higher heating demand over the next two weeks along with close to record high U.S. liquefied natural gas (LNG) export demand projections due to a recent surge in European gas prices. The forward power price strips through 2026 were +1% higher on average over this past week with the 2022/23 strips trending +3% higher, while the longer-term prices for 2025/26 remaining unchanged. Those forward prices are mostly -8% to -12% below the all-time high prices set for the 2022 term, while the outer terms of 2025/26 still remain at their all-time highs that were established this past October. Index prices are markedly lower month-over-month, but still much higher year-over-year. The day-ahead index power prices in West Hub month-to-date for December are averaging $38.14/MWh or -40% lower than last month but still +59% greater than the December average of 2020, while the month-to-date average settlement price for the Eastern Hub is currently $43.47/MWh or -38% lower than the last month’s average but +59% greater than December average of a year ago.

• Lawmakers Lack Votes to Halt RGGI – On 12/15 the House of Representatives on 12/15 fell short in their attempt to secure a veto-proof majority on a resolution disapproving the Regional Greenhouse Gas Initiative (RGGI) rulemaking. After a prolonged debate, the vote outcome was 130 to 70, six votes shy of the 136 votes necessary to secure a veto override. The disapproval resolution will now head to the Governor’s desk where it will be vetoed. Neither the Senate nor the House were able to achieve a veto-proof majority on the resolution making a successful veto-override vote all but impossible. It is unclear at this time if the Legislative Reference Bureau (LRB) will publish the rulemaking following the Governor’s veto or if the LRB will wait for the Senate to hold a veto override attempt. If the LRB were to publish immediately, Pennsylvania would officially participate in RGGI beginning in January 2022; if they wait for the Senate to attempt a veto-override, RGGI participation would potentially be delayed until July 2022.

|

|

|

|

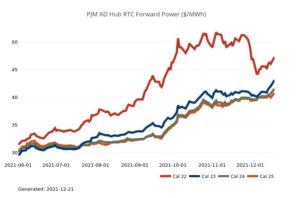

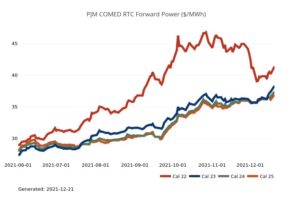

Great Lakes Electric Summary

• The Great Lakes Region’s forward power prices moved up last week, mostly on the front part of the pricing curve (2022/23) despite natural gas prices that trended slightly downward during that time. Those power prices could see some more price support heading into the holiday weekend as U.S. natural gas futures rose, Monday, on forecasts for colder weather and higher heating demand over the next two weeks along with close to record high U.S. liquefied natural gas (LNG) export demand projections due to a surge in European gas prices. The forward power price strips through 2026 were +1% higher on average over this past week with the 2023 strips about +3% higher, while the longer-term prices for 2025/26 remained unchanged. Those forward prices are within -10% to -14% of the all-time high prices set for 2022, while the outer terms of 2025/26 still remain at their all-time high prices that were established this past October. Index prices are markedly lower month-over-month, but still much higher year-over-year. The day-ahead index power prices in AdHub month-to-date for December are averaging $39.69/MWh or -35% lower than last month but still +62% greater than the December average of 2020, while the month-to-date average settlement price for COMED is currently $32.02/MWh or -32% lower than the last month’s average but +42% greater than December average of a year ago.

• Ameren to Retire Plant Rather Than Install Air Controls – On 12/14, Ameren Missouri announced its intent to retire its coal-fired Rush Island power plant in 2024, 15 years earlier than previously planned, rather than install a wet scrubber to control air emissions. In 2019, a federal district court ordered Ameren to install a scrubber at the 1,200 MW plant by 2024, finding that the plant violated the Clean Air Act’s new source review (NSR) program by undertaking major modifications in 2007 and 2010 without obtaining a prevention of significant deterioration (PSD) permit. According to court filings, the scrubber could cost as much as $2.5 billion. The case was a test of EPA’s ability to obtain injunctive relief from courts for years old NSR violations and shows that EPA air permitting enforcement actions can lead to significant outcomes.

|

|

|

|

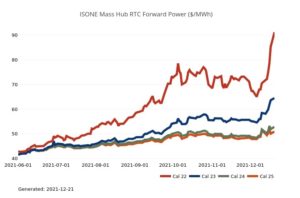

Northeast Energy Summary

• Last week was a bumpy ride for forward natural gas and power prices in New England markets. European natural gas prices led the way as the January Dutch TTF contract (European benchmark) powered through its previous all-time high of $39/MMBtu and reached $47/MMBtu off the news that 2 nuclear power plants in France were to come off line unexpectedly with 2 existing offline units to remain on the sidelines longer than anticipated. As such, an already tight natural gas market got even tighter as pressure and demand for natural gas in the region is expected to elevate even higher for the winter. Additionally, the chance for Russian to become the region’s knight in shining armor continues to be de minimis as key pipeline entry points for supply from Russia to Germany saw zero capacity flows last week. With LNG imports a potential key to risk mitigation in New England, the move up in the global markets also pushed Algonquin natural gas forwards up ~$10/MMBtu for January and February delivery to ~$30/MMBtu, in turn driving power forwards higher as well. Also contributing to the week’s volatility were some mid-day weather model runs showing starkly colder changes to 2 week forecasts for the Northeast region. Since initial colder runs, overall forecasts continue to moderate and the upward price pressure has proved unsustainable for now.

• On December 16th, a Maine court denied a request for preliminary injunction from the New England Clean Energy Connect (NECEC) to halt implementation of the ballot initiative approved by voters on November 2. NECEC had hoped to keep the initiative from becoming law on December 19 while the substantive legal issues are addressed. The Business & Consumer Court determined, however, that allowing the initiative to go into effect will not violate NECEC’s constitutional rights or constitutional principles. The Court first rejected NECEC’s “vested rights” argument stating, “The vested rights doctrine does not apply, and to the extent it does, Plaintiffs’ rights to continue building the corridor did not vest.” The Court also concludes the initiative does not violate Separation of Powers principles under the Constitution because the initiative does not reverse a specific executive branch decision, nor does the initiative usurp prior judicial branch decisions that, in this case, are only generally related to NECEC. The Court also found the initiative does not violate the Contracts Clause of the Maine and U.S. Constitutions because the Court had already invalidated a lease of public lands to NECEC that formed the basis of NECEC’s claim. The decision notes that there are many legitimate issues raised by NECEC, and it expects the Law Court (the Maine Supreme Court) to expeditiously consider the merits of those legal considerations. The state-wide referendum at issue, which passed by 59-41, rescinds the state siting permit for NECEC and would require an affirmative vote by the legislature for any transmission project in Maine, retroactively to 2020, as well as a two-thirds legislative vote for a project crossing public land, retroactive to 2014. NECEC has disclosed that it has already spent $450 million on the project, which is currently paused and will need to be fully stopped upon the referendum going into effect 12/19. Per contracts with the Massachusetts EDCs for the power over the line, the project must have a commercial operation date of no later than August 23, 2025 – although NECEC was originally scheduled to be completed in December 2022. The completion of the NECEC has been relied on, in part, by ISO-NE to solve tarriff violations created by some key generation retirments over the past couple of year.

• On December 15th, the New York City Council voted to ban the use of natural gas in new buildings to further electrify the city’s building stock and help achieve carbon neutrality by the year 2050. New buildings will have to use electricity for heat and cooking. However, existing buildings will not be affected. The new law applies to new buildings under seven stories high beginning in December 2023 and those over seven stories in 2027. New buildings used for manufacturing, hospitals, commercial kitchens and laundromats will be exempt from the moratorium. This action follows the Climate Mobilization Act (Local Law 97) passed by the City Council in 2019 that established emission caps on all buildings 25,000 square feet and larger – roughly 50,000 residential and commercial properties in New York City – that takes effect in 2024.

|

|

|

|

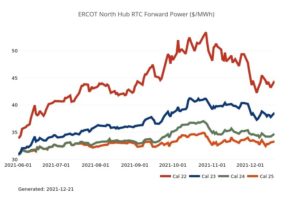

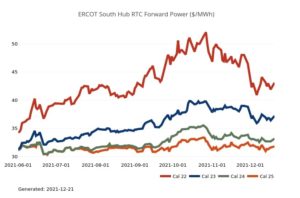

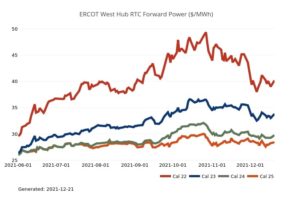

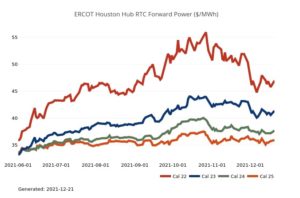

ERCOT Energy Summary

• Real-time prices last week averaged $23.23/MWh in the North Zone last week (December 13th – December 19th) with an hourly high price of only $59.88/MWh, so it was a much quieter week overall as temperatures highs got to the mid 70’s to low 80’s. Average ERCOT load averaged 41.7 GW last week, while average wind output averaged ~15 GW while solar averaged 1 GW for the week.

• This coming Christmas week will see temperatures in Dallas dip on Monday to a high of 59 F but then to the upper 70’s/80F by Christmas week. Load will vary between 36-44 GW and wind will average between 5.5 to 21 GW for the holiday week.

• On December 16th, the PUCT held its important meeting to approve market design changes. As expected, the PUCT approved Phase 1 of its Market Redesign initiatives. The new ORDC curve will have a price cap of $5,000/MWh, down from $9,000/MWh price level, and a minimum contingency level (MCL) of 3,000 MW, versus the current level of 2,000 MW. The PUCT directed the Commission staff to work with ERCOT to identify any hurdles that would prevent implementation and report back by January 10th. The changes to the ORDC curve will increase average annual energy market revenues by $2/MWh, according to the Brattle Group.

• For Phase 2 of the PUCT’s market reforms, the PUCT did not vote to proceed with reforms designed to ensure that sufficient dispatchable resources are available to meet the reliability needs of the grid year-round. The commissioners requested staff and ERCOT report back by 2/15 regarding the specific inputs and considerations the Commission should evaluate with these reforms. The PUCT’s choice to delay decision-making on the Phase 2 elements of the Blueprint continues the regulatory uncertainty that has plagued the market since winter storm Uri and leaves the market wondering if the PUTC will ultimately adopt a market design that pays for reliability, potentially stalling new investment and promoting retirements of older thermal units in the near term.

|

|

|

|

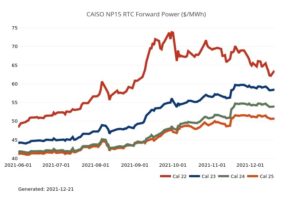

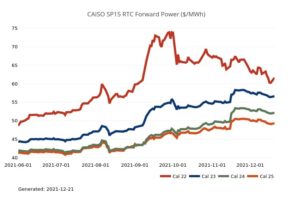

CAISO, Desert Southwest and Pacific Northwest Energy Summary

• The forecast is showing expectations for cooler temperatures up and down the West Coast through the end of the year. The first Stage 3 alert of the season on the SoCalGas system on Monday, along with a shift in the national picture for increased heating demand, provoked an upward turn on the price dial a couple of notches despite reduced industrial demand around the holidays. As noted in our last update, SoCalGas has been able to keep Aliso Canyon in the dispatch order because of maintenance on some of their other fields, allowing them to utilize that cavern more than the smaller facilities. Over the past week, it appears that Aliso has been taken down to 39.5 Bcf by drawing roughly 3 Bcf, double what the other fields on their grid contributed to the balancing, combined. This outsized lean on Aliso is likely also what kept SoCal daily prices at the city gate below the $10 per MMBtu level all last week. As we look forward this week, average temps in the L.A. Basin are going to stay near 57 degrees and, even with the reduced holiday load and some small increases in renewable production, SoCalGas should see sendouts remain above 3.1 Bcf and continue to draw from the Aliso field while issuing low OFOs. The outlook right now for next week indicates that the L.A. Basin will see temps average near 48 degrees, which will be the coldest conditions yet this season. Late last week, El Paso Pipeline posted an updated maintenance schedule carrying the 0.6 Bcf restriction on Line 2000 through the end of January. With no change in flows along this line and the upcoming cold, there’s still a fighting chance that we see daily gas trade into the double digits by year end.

• We were asked recently if last week’s “Atmospheric River” that soaked the state for a few days and kickstarted the ski season with a giant snowstorm in the Sierra changed anything with regard to the drought conditions. Because of the reporting period, effects of the storm were not picked up in last week’s Drought Monitor update, so we will need to wait for this Thursday’s release. Our early read is that there was little material effect, and it’s going to take more than one storm to break the back of the drought. But there was one upside; the fires are out.

• In a Jeff Gillooly-caliber whack to the knee of California solar providers, the CPUC proposed major changes to the state’s booming residential solar industry last week in the form of reduced discounts for homeowners’ with rooftop solar and storage systems. Under current net metering rules, when a homeowner spins their meter backwards and pushes surplus kWh from their system onto the grid, the utility buys it from them at a price far above wholesale rates. This aspect of the program, along with strong subsidies established over 20 years ago with the goal of encouraging more homes to go solar, worked. California now has 1.3M resi solar systems, far more than any other state, according to the solar industry. Now, in the name of equity for ratepayers unable to afford the benefits of a home system or renters, the CPUC put forth reforms that would reduce incentives for going solar and roughly double, to 10 years, how long it takes to recoup the cost of installing a system. The CPUC’s proposal would still allow resi solar to sell their excess energy back to the utility, but at a significantly lower rate. The homeowner would also face a grid charge based on how many kWh of energy they produce, likely costing $40-$50 per month for most homes. A PG&E solar customer currently gets an average of more than 20 cents for every kWh their system pushes onto the grid. The proposed new rate would be based on a complicated “time of use” system and would likely amount to 10 cents or less per kWh for most, and it would be combined with a higher phased-in grid access charge intended to cover the cost of maintaining the home’s connection to the grid. This proposal sparked a giant outcry from the resi solar industry which sees a sudden contraction in demand and homeowners who face the roughly $40K expense of a solar and storage system, a requirement since 2020 on all new builds.

And to all a good night – from everyone at TruPowur, have a safe and Happy Holidays . Catch you again in the New Year.

|

|